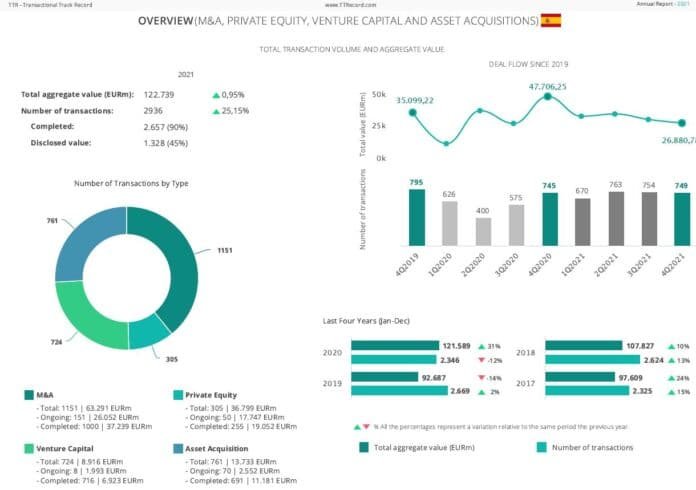

According to the recently launched TTR’s annual report of M&A activity in Spain, deal volume increased 25% in Spain in 2021 over 2020 to 2,936 transactions, of which 2,657, or 90%, closed by year-end. Aggregate deal value increased 1% to €122.74bn, meanwhile, based on 1,328 transactions of disclosed consideration. The Real Estate sector led by deal volume, with 578 transactions, up 14% over 2020; the Technology sector followed closely, with tech 555 deals, a 30% increase relative to 2020. The Financial Services industry ranked third by volume, accounting for 226 transactions, followed by the solar energy industry, with 210 deals, up 36% and 88%, respectively, over 2020.

Private Equity deal volume in Spain increased 41% to 305 transactions in 2021, while the aggregate value of Private Equity deals grew 82% to €36.8bn, based on 105 deals of disclosed consideration.

Of the total Private Equity deals announced, 255, or 84%, closed by year-end. Private Equity investors targeted consulting, audit and engineering firms and technology companies in equal measure, each accounting for 33 deals, the former up 154% over 2020, the latter up 83% by volume. The Health industry attracted 23 private equity investments in 2021, the distribution and Retail sector 20, up 15% and 25%, respectively, relative to 2020 deal volumes. There were eight Private Equity exits in Spain from financial services companies in 2021, representing an increase of 60% relative to the number of exits in the segment in 2020. Private Equity investors exited seven companies in the consulting space and another seven in the consumer goods segment, up 600% in both relative to 2020. Private Equity investors made six exits from technology companies, meanwhile, a 100% increase over 2020.

Venture Capital (VC) transactions increased 27% by deal volume and 7% by aggregate value in Spain in 2021, with a total of 724 deals worth a combined USD 8.92bn, based on 599 deals of disclosed consideration.

Of the total announced VC transactions, 716, or 99%, closed by year-end. The technology sector attracted the most VC financing, representing 324 transactions, followed by 110 Internet-related investments, 85 financial services investments and 54 biotechnology investments. Venture Capital investments in Technology companies increased 23% in 2021, Internet deals were up 28%, and financial services investments increased 85% by deal volume over 2020. VC investment in Biotech targets fell 21% by volume relative to 2020, meanwhile. VC funds exited from 14 technology companies, a 56% increase over 2020, 12 Internet-related businesses, up 300% over the previous year, three financial sector entities, on par with 2020, and three Biotech firms, up from one in 2020, meanwhile.

The number of IPOs in Spain increased from 21 in 2020 to 27 in 2021, of which 20, worth a combined €2.9bn, closed by year-end. The number of announced and closed follow-on transactions fell by a single deal to 46 in 2021 relative to 2020, with 34 closing by year-end. The aggregate value of announced and closed IPOs increased by 1,167% from €258m in 2020 to €3.01bn between 2020 and 2021, while the combined value of follow-on transactions grew 18% from €9.28bn to €10.92bn.